Aug 12, 2023

Whatʼs the Best Public Adjuster CRM and Claim Management Software? (Updated Nov, 2024)

Originally published August 12, 2023, updated November 11, 2024.

Feeling overwhelmed by the sea of SaaS (i.e. Software-as-a-Service. This means cloud-based software that runs in a browser or app) options for public adjusters? You're not alone! Let's cut through the noise and explore eight options that could transform your claims management process.

As a public adjuster with nearly a decade of experience, I'll share my honest, unfiltered insights about each platform. This article has already ruffled some feathers (the honest part), but my hope is that software companies will listen to the market's needs, and innovate to deliver the features public adjusters need.

Important Notes

This review comes from my personal experience as a public adjuster. I'm not affiliated with any software companies and haven't received compensation for these reviews. In fact, a few are not very pleased with my reviews, because they are honest about improvements that need to be made to better serve our industry.

As someone who test 100-300 apps per year through consulting and professional interest, I can safely say that our industry has not receive the same innovation that general SaaS categories have… Until recently. We not only have a few more options available to us, but there are more being developed, and some of our existing options have introduced updates and new features!

Understanding Software Selection

SaaS products are swiftly becoming indispensable components of every business' toolkit, especially in the claims industry. They streamline our processes, simplify complex tasks, and ultimately, allow us to do more with less.

Here's the thing: no SaaS platform, irrespective of the industry it serves, is perfect.

Choosing the right software is crucial for modern public adjusting firms. While SaaS tools can streamline your work and boost efficiency, there's no one-size-fits-all solution. Each platform has unique strengths and limitations - what works perfectly for one firm might be completely wrong for another.

The key is matching software to your specific needs. Consider:

Your team's workflow

Technical comfort level

Budget constraints

Required features

Growth plans for your business

In this review, I'll share insights from my decade of experience as a public adjuster, focusing on core functionality while acknowledging that each business has unique requirements. Whether you prefer a custom solution or an out-of-the-box platform, remember that even the most sophisticated software is just a tool - its value depends on how well your team implements and uses it.

The best software is the software you'll actually use everyday.

Need help making your choice? My Software Selection Toolkit walks you through the evaluation process step by step. It's the most comprehensive tool of it's kind that you'll find, that covers everything from investigating the background of the company, to security, and beyond, in an easy to follow format.

For personalized guidance, personalized consulting (available on a limited basis) can analyze your specific needs and recommend the perfect solution for your firm.

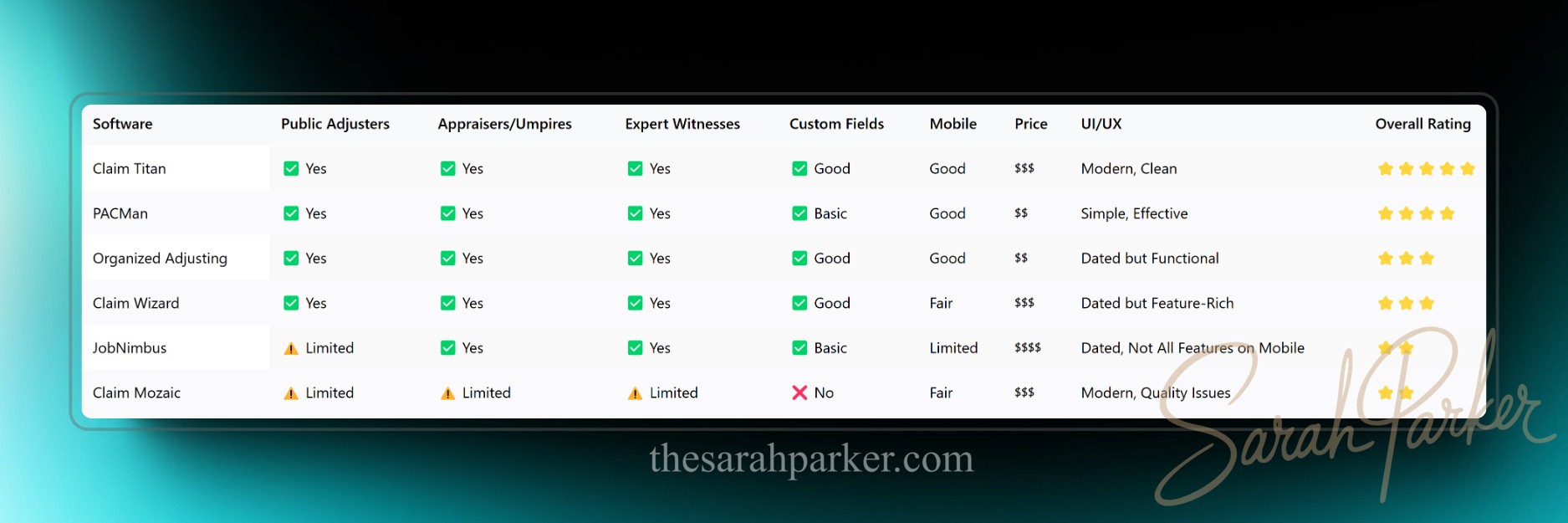

Quick Reference Table: Core Features

Overview - Get to Know Each Software

☁️ JobNimbus ⭐⭐

Legacy roofing contractor app founded in 2011, sub-marketed to public insurance adjusters. Convenient, industry-specific integrations to speed up your workflows and data-gathering property restoration projects related to claims.

Pros:

Normal project management functionality

Contact management

Project tracking

Limited task automations

User-friendly interface

Integrates with QuickBooks, EagleView, and more

Zapier integrations available

Works well for expert witness services, appraisal, and umpire work

Upcoming marketing features

Friendly and responsive support

Cons:

Made for contractors and roofers, but sub-marketed to public adjusters, therefore missing many features and functionality that public insurance adjusters require

One of the most expensive options, non-transparent pricing

Lacks some modern customization options

Integration challenges for non-technical teams

Limited mobile app functionality

Lacks complex claim financial tracking

Support couldn't address regulatory compliance questions

Limited for true claims management

Thoughts:

Public Adjusters: Not recommended

Expert Witnesses: Can work

Appraisers/Umpires: Can work

Overall: Too expensive for the limited functionality, and lack of effectiveness for proper claims management

JobNimbus YouTube walkthrough

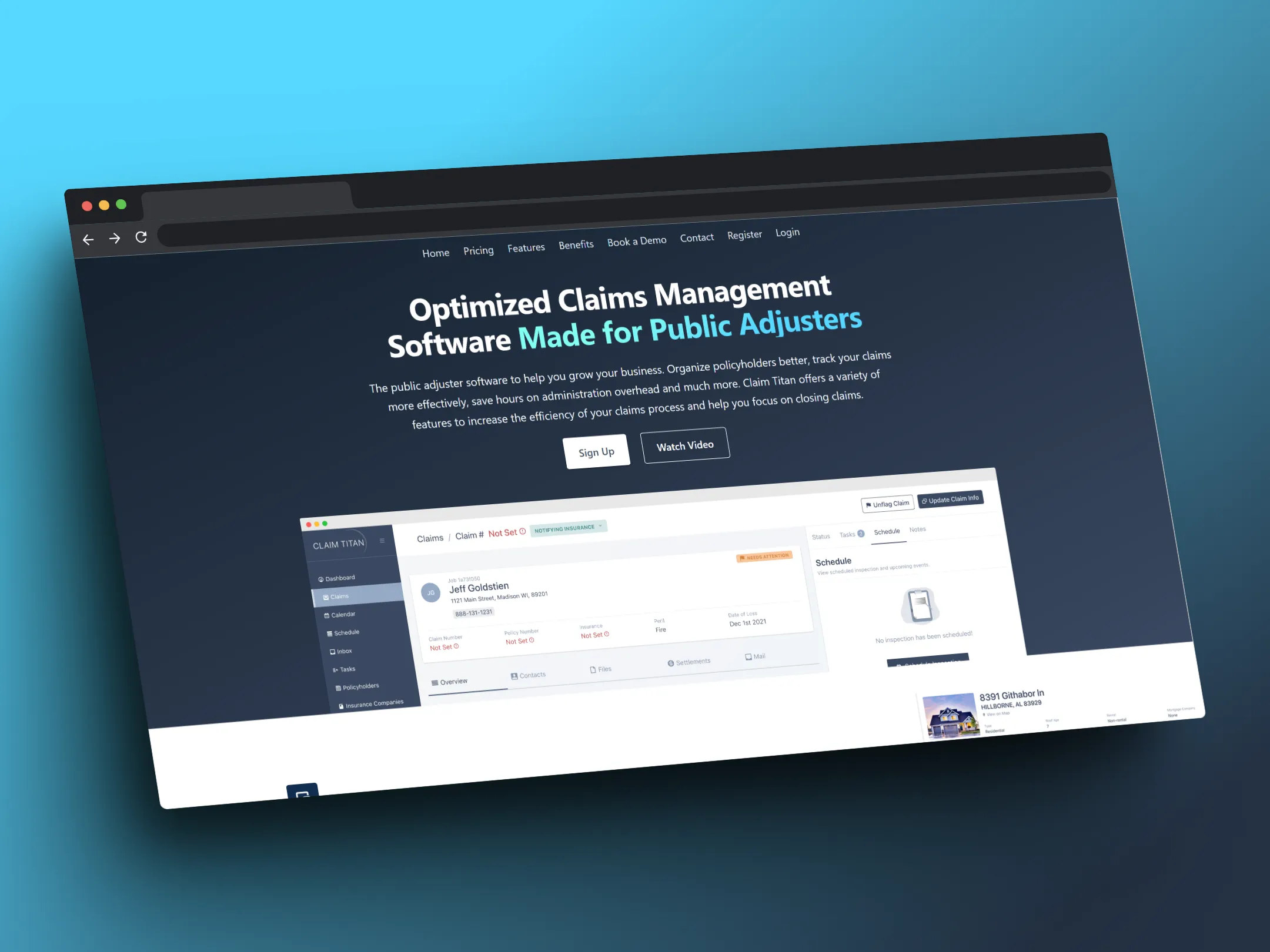

🪐 Claim Titan ⭐⭐⭐⭐⭐

New platform with detailed, modern interface. Store your video files as well as your documents and photos.

Pros:

Comprehensive claim management features

Strong analytics and reporting capabilities

Responsive founder implementing feedback

Continual feature additions

Modern mobile browser design

Solid framework for new adjusters

Created by a public insurance adjuster

Cons:

Learning curve for interface

Higher cost than some options

May be overwhelming for new adjusters

Newer software with some features still in development

Limited external automations and integrations (planned for future)

Thoughts:

Public Adjusters: Yes

Expert Witnesses: Yes

Appraisers/Umpires: Yes, but may have more features than needed

Overall: Top choice

Claim Titan Live, on Listen to This Bull Podcast

📚 Organized Adjusting ⭐⭐⭐

Well-balanced features with unique routing function that maps your field visits for the day! A nice option for appraisers, umpires, and expert witnesses as well.

Pros:

Strong document management

Easy claim progress tracking

Extensive custom fields

Friendly support

Daily auto-routing feature

Cons:

Lacks some advanced features

Outdated UI but not bad

Limited external integrations

Missing their old orange UI design flair

Thoughts:

Public Adjusters: Yes

Expert Witnesses: Yes

Appraisers/Umpires: Yes

Overall: Nice option

👾 PACMan Software ⭐⭐⭐⭐

Originally launched in 2007 and recently updated/modernized, enjoy simple claims management, pleasant UI/UX design, and easy-to-use functionality. Use this app almost immediately out-of-the-box, and cut down on new technology adoption time and training.

Pros:

Excels in simplicity and essential features

Winner in "ease of use" category

Great for beginning adjusters or new firms

Convenient features like "Claims Last Touched" and "Diary Search"

Projections and reporting included

Excellent and responsive support

Clear value proposition

Financial and reporting functions

Client portals

Cons:

UI not as intuitive as competitors

Limited external app integration

May not suit complex needs

No external integrations known

Thoughts:

Public Adjusters: Yes

Expert Witnesses: Yes

Appraisers/Umpires: Yes

Overall: Great option for professionals that are new to the industry or enjoy simplicity

PacMan YouTube walkthrough

🧙🏾♂️ Claim Wizard ⭐⭐⭐

Established in 2013, and one of the most-used public insurance adjuster-specific claim management tools. Pair their founders' business consulting with your claims management app, for holistic business growth and support.

Pros:

Well-rounded feature set

Easy client portal integration with website (one of my favorite Claim Wizard features!)

Strong customer support team

Experienced founders, with decades of experience supporting public adjusting firms of all sizes

Industry support focus

Additional business consulting

Proudly supports the public insurance industry profession and education

Ample and detailed support documents, guides, templates, and walkthroughs to learn the software

Cons:

Outdated UI/UX

Challenging mobile experience

Payment tracker issues

Steep learning curve

Manual data entry redundancy

WordPress-focused integrations

Limited non-WordPress options

Thoughts:

Public Adjusters: Yes

Expert Witnesses: Yes, but more features than needed

Appraisers/Umpires: Yes, but more features than needed

Overall: Not my favorite, but good business training

🐦 Claim Mosaic ⭐⭐

New software. Modern interface with extremely limited flexibility and limited features.

Pros:

Clean, modern UI

Uncluttered dashboard

Standard views (Claim Board, Lead Board, Task Board, Map View, Calendar)

Basic policy information fields

Includes fields for agent, mortgage company, and insurer

Report builder is a nice feature, allows you to customize PDF reports for export and sharing

Cons:

Not sure that the developer has personal knowledge of the industry, due to the oversight in design of the fields, options, and interface, and typos and mismatched insuring terms throughout the app

Rigid structure with no custom fields

Limited to residential claims, by the interface options and pre-set fields (was not intended by the developer I believe, so this is of concern)

Structure does not support use for commercial or other multi-building properties

Policyholder entries do not support entity policyholder information, only natural persons

Only supports listing one mortgage company

Bright, mismatching colors can be distracting and overwhelming

Display sizes in the interface are sometimes too large, or too small

Confusing terminology (e.g., unexplained "appraisal clause" options)

Address required for signup

Insufficient tooltips and guidance

Thoughts:

Public Adjusters: Not recommended

Expert Witnesses: Not recommended

Appraisers/Umpires: Not recommended

Overall: Too rigid for professional PA work, buy possibly ok for beginners that want to work residential claims only

🤓 Freeform Solutions ⭐⭐⭐⭐

Build out your own solution from many freeform options, that can be self-hosted or hosted for you. Might be amazing for some organizations, and might be too complicated and/or costly for others.

Pros:

Maximum flexibility

Customizable tool selection

Good for experienced firms

Typically low monthly costs

Cons:

Requires technical expertise

Can create inefficiencies

Challenge finding competent consultants

Time-intensive

Not suitable for new professionals

Cost range: $2,500-$20,000 (to build it out/customize)

💸 Custom-Coded Solutions ⭐⭐⭐⭐⭐

Near perfection might be possible... If you have a lot of money and time to invest, and if you find the right company to implement it for you. Probably a good idea to do your due diligence, before you start. It may be helpful to work with a consultant.

Pros:

Highest level of customization

Tailored to unique needs

Different from freeform solutions

Can have anything you want

Budget range: $10,000 to $200,000 or more

Cons:

Generally most expensive option

Significant resources for development

Ongoing maintenance needs

Who Wins?

Well, here's my ranking, in order of personal preference:

Claim Titan ⭐⭐⭐⭐⭐

PACMan Software ⭐⭐⭐⭐

Claim Wizard ⭐⭐⭐

Organized Adjusting ⭐⭐⭐

Job Nimbus ⭐⭐

Claim Mosaic ⭐⭐

Final Thoughts

After reviewing these eight claims management solutions, it's clear that each serves different needs within the public adjusting industry:

Claim Titan leads the pack with its comprehensive features and modern interface, while PACMan offers an excellent entry point for newer firms.

Custom solutions provide ultimate flexibility for those with larger budgets, and Organized Adjusting delivers solid fundamentals with unique routing capabilities.

While some options like Claim Wizard and JobNimbus have their merits, they may require careful consideration of their limitations.

Claim Mosaic, though modern in appearance, lacks the flexibility needed for complex claims work.

The key is to match your selection with your specific requirements: consider your claim types (residential, commercial, HOA), team size, technical capabilities, and budget.

Remember that the most expensive option isn't necessarily the best fit, nor is the newest always the most effective. Take time to demo your top choices, and don't hesitate to reach out, or try my Software Selection Toolkit for personalized insight to help in making crucial decisions for your business.

What Do You Recommend, or Have Questions About?

Do you have a SaaS you'd like me to review and add? Let me know!